Paycheck tax calculator 2023

How to calculate annual income. On the other hand if you make more than 200000 annually you will pay.

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

For example if an employee earns 1500.

. It will be updated with 2023 tax year data as soon the data is available from the IRS. 2022 Federal income tax withholding calculation. The state tax year is also 12 months but it differs from state to state.

Ad Compare This Years Top 5 Free Payroll Software. It can also be used to help fill steps 3 and 4 of a W-4 form. Plug in the amount of money youd like to take home.

Use this tool to. Learn About Payroll Tax Systems. 2022 to 2023 rate.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. It will be updated with 2023 tax year data as soon the data is available from the IRS.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Access Office Client Portal.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. Try out the take-home calculator choose the 202223 tax year and see how it affects.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software.

Prepare and e-File your. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. See how your refund take-home pay or tax due are affected by withholding amount. To use the Office Client Portal you will need to be activated by your HR Block office and have your user name and password.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Sign Up Today And Join The Team. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Our Premium Calculator Includes. Due to federally declared disaster in 2017 andor 2018 the. Our Premium Calculator Includes.

The same goes for the next 30000 12. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Prepare and e-File your.

For 2022-23 the rate of payroll. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Learn About Payroll Tax Systems.

Free Unbiased Reviews Top Picks. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Over 900000 Businesses Utilize Our Fast Easy Payroll.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee.

Some states follow the federal tax. Call us on 132325. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Sign Up Today And Join The Team. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution Ani Globe. FAQ Blog Calculators Students Logbook. The Tax Calculator uses tax.

See where that hard-earned money goes - with UK income tax National Insurance student. Estimate your federal income tax withholding. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Subtract 12900 for Married otherwise. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Social Security What Is The Wage Base For 2023 Gobankingrates

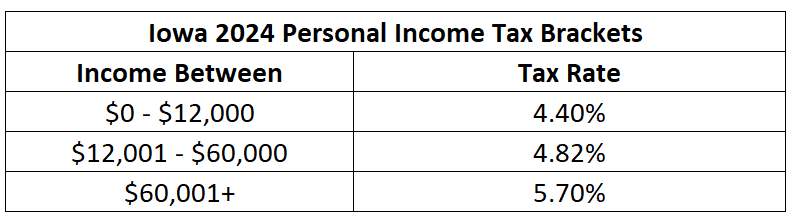

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

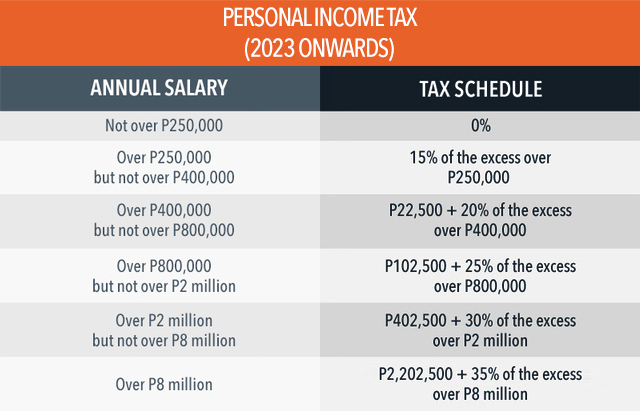

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Tax Calculator Compute Your New Income Tax

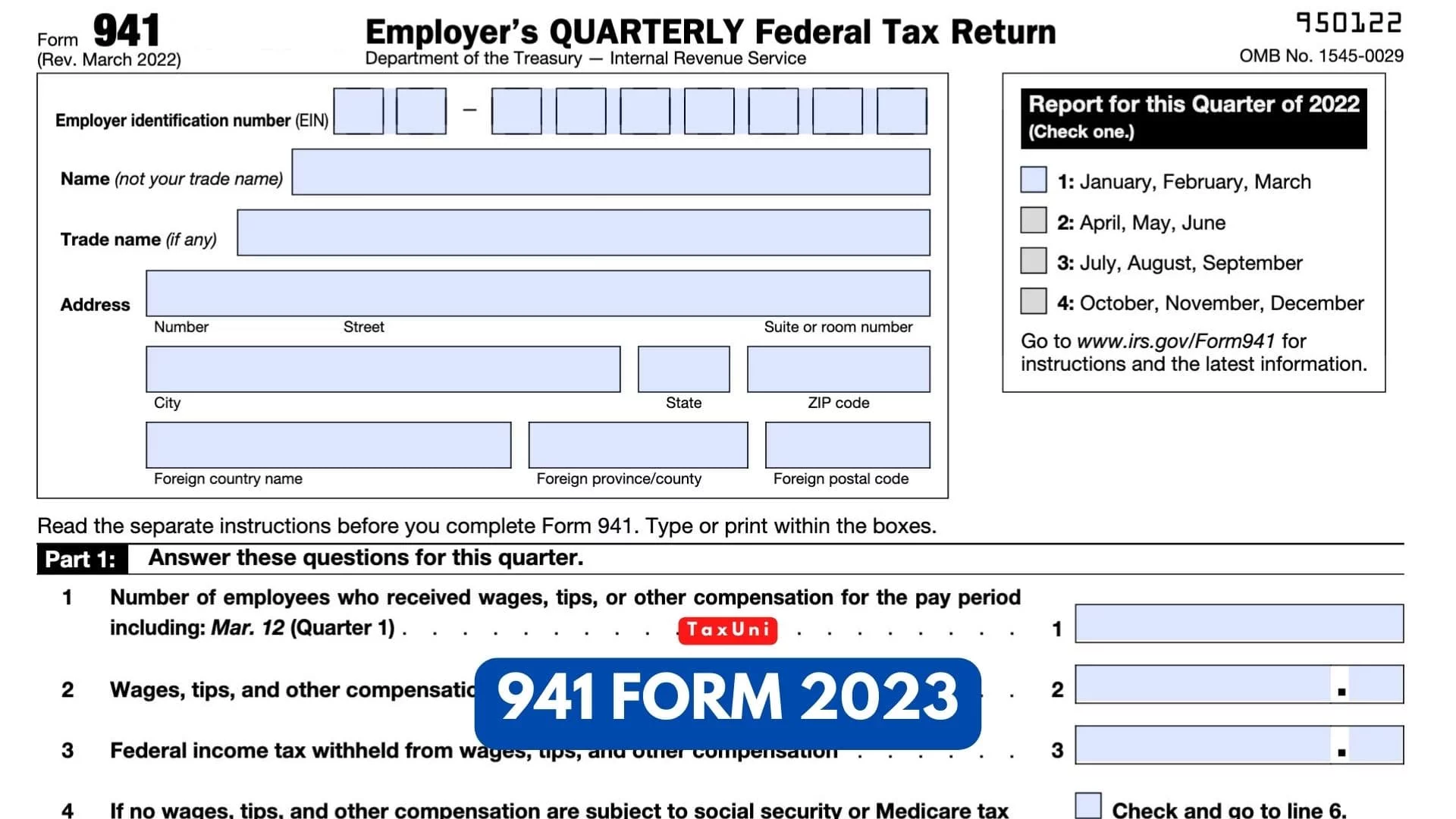

941 Form 2023

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Income Tax Slab Fy 2022 23 Ay 2023 24 New Income Tax Slab Rate For Fy 2022 23 Ay 2023 24 Youtube

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

2022 Budget Planner Worksheets Free Printable Printables And Inspirations Budget Planner Budgeting Budget Planner Worksheet

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Free Excel Download Commerceangadi Com

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

New York State Enacts Tax Increases In Budget Grant Thornton

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits